year end accounts extension

File annual accounts with Companies House. Pay corporation tax or inform HMRC your limited company doesnt owe any.

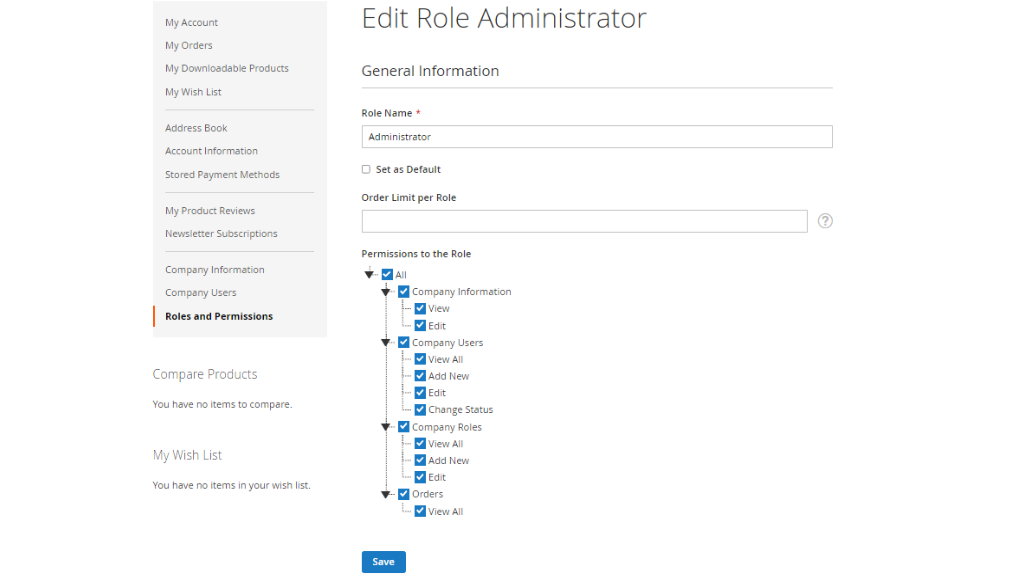

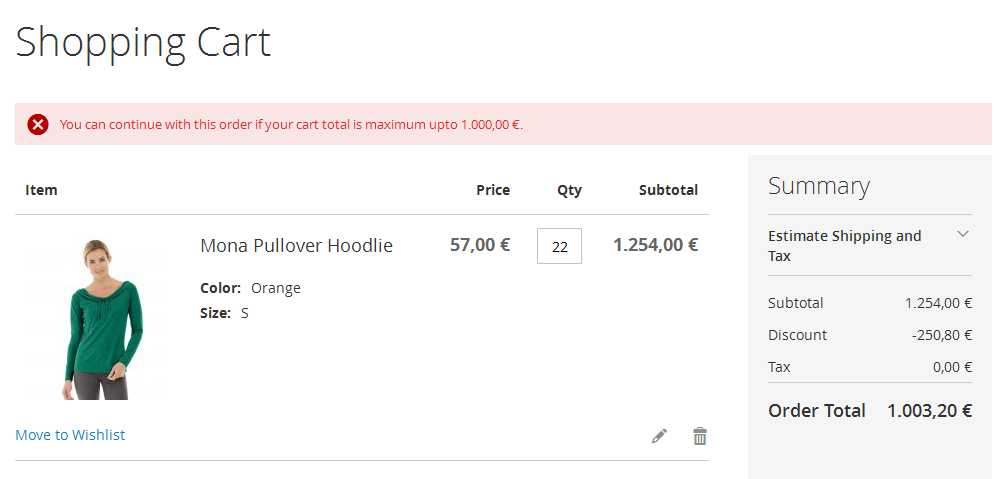

Level B2b Experience With Company Accounts Extension For M2 Aheadworks

This joint initiative between the.

. A health FSA may allow participants to carry over unused benefits from a plan year ending in 2020 to a plan year ending in 2021 and from a plan year ending in 2021 to a plan year ending. You can shorten your companys financial year as many times as you like - the minimum period you can shorten it by is 1 day. You must send your application to us before your normal filing deadline.

6 April 2021. Temporary Extension To Company Accounts Filing Deadlines. The year-end tasks in accounts payable are critical to accurate financial statements for any organization.

Company C were granted a 3 month extension for their. To apply online youll need. 9 months after the end of your companys financial year.

Any documents you have that. The announcement is an. If you take advantage of the accounts filing.

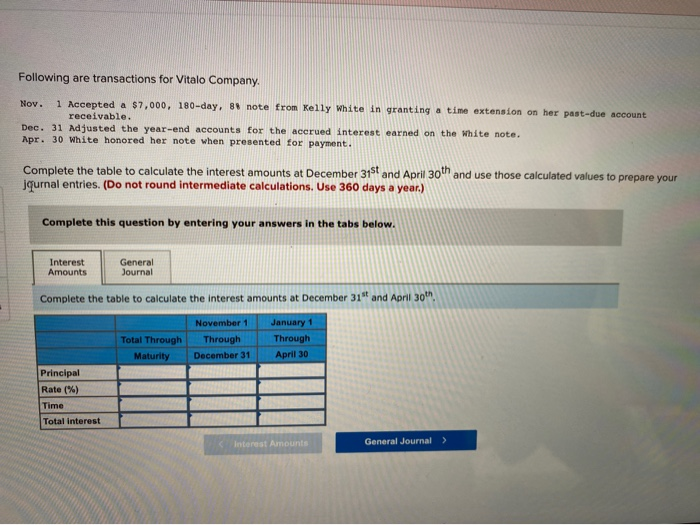

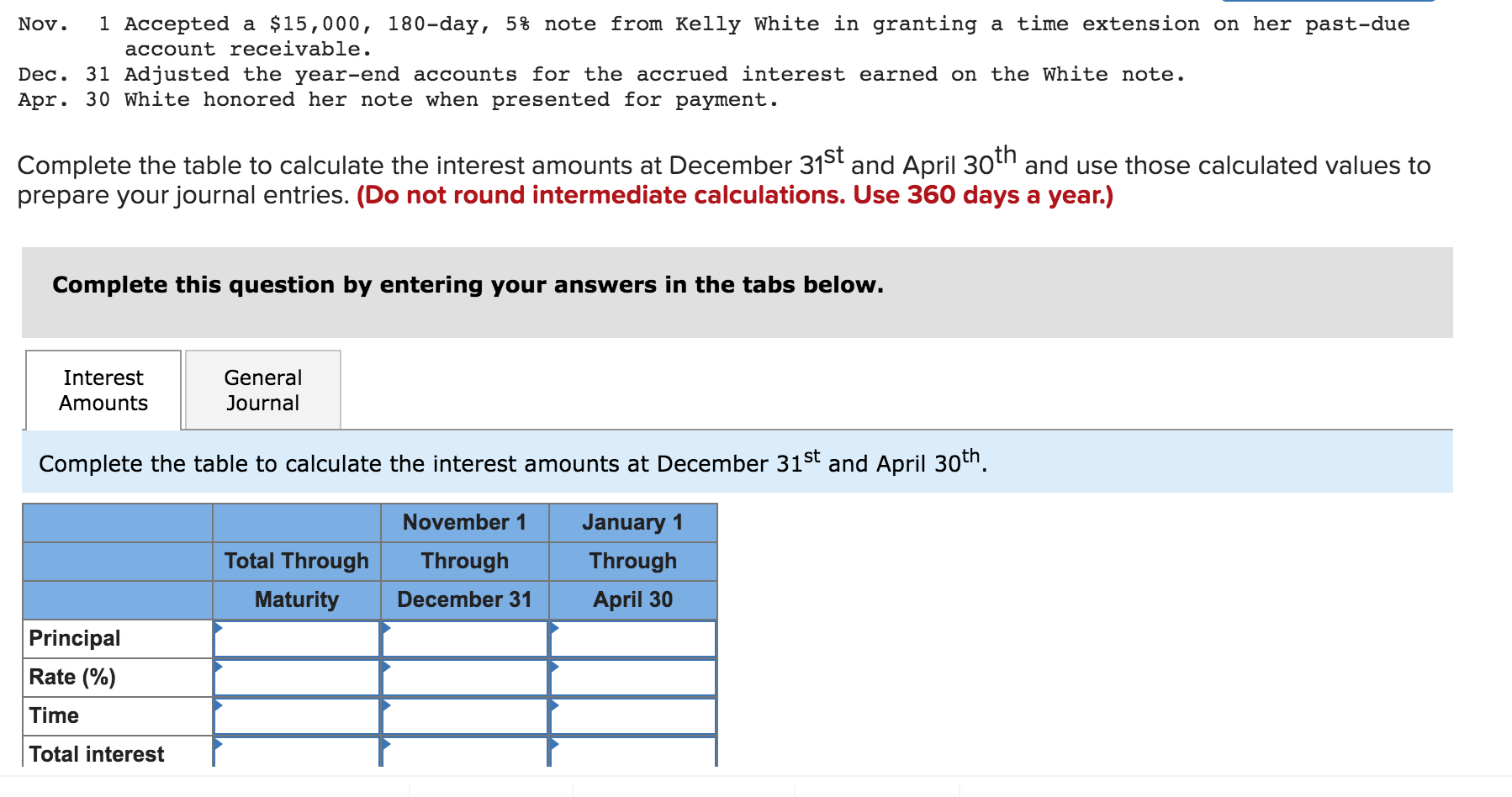

For examples a private limited company with an accounting year-end date of 31 March. 1 Accepted a 6000 180-day 8 note dated November 1 from Kelly White in granting a time extension on her past-due account receivable. You can apply for more time to file if something has happened that is out of your control and you cannot.

Yet often they are a last minute affair and proper attention is not accorded the. The rules on changing your financial year end. 31 Adjusted the year-end accounts.

The automatic extensions granted by. A client may well wish to extend his year end of 30th November 2019 to 31st May 2020 sold and it makes sense for one set of longer accounts. You can legally extend your year-end up to an 18-month accounting period as long as it has not been extended in last five years.

From today 25 March 2020 businesses will be able to apply for a 3-month extension for filing their accounts. Information about why you need more time. To find out more about year end accounting for businesses call 01384 261300 to speak to a member of our helpful and friendly team.

The automatic extensions granted by the Corporate Insolvency and Governance Act have come to an end. Keep in mind that this is only an overview of what is needed for your year-end accounts. You can apply online or by post.

Extending a year end. Reg 11 substitutes 12 months for 9 months as the period allowed after the end of the relevant accounting reference period for submitting accounts of a private limited.

Tax Senior Accountant Job Description Velvet Jobs

How To Extend Your Filing Deadline Hack Limited Company

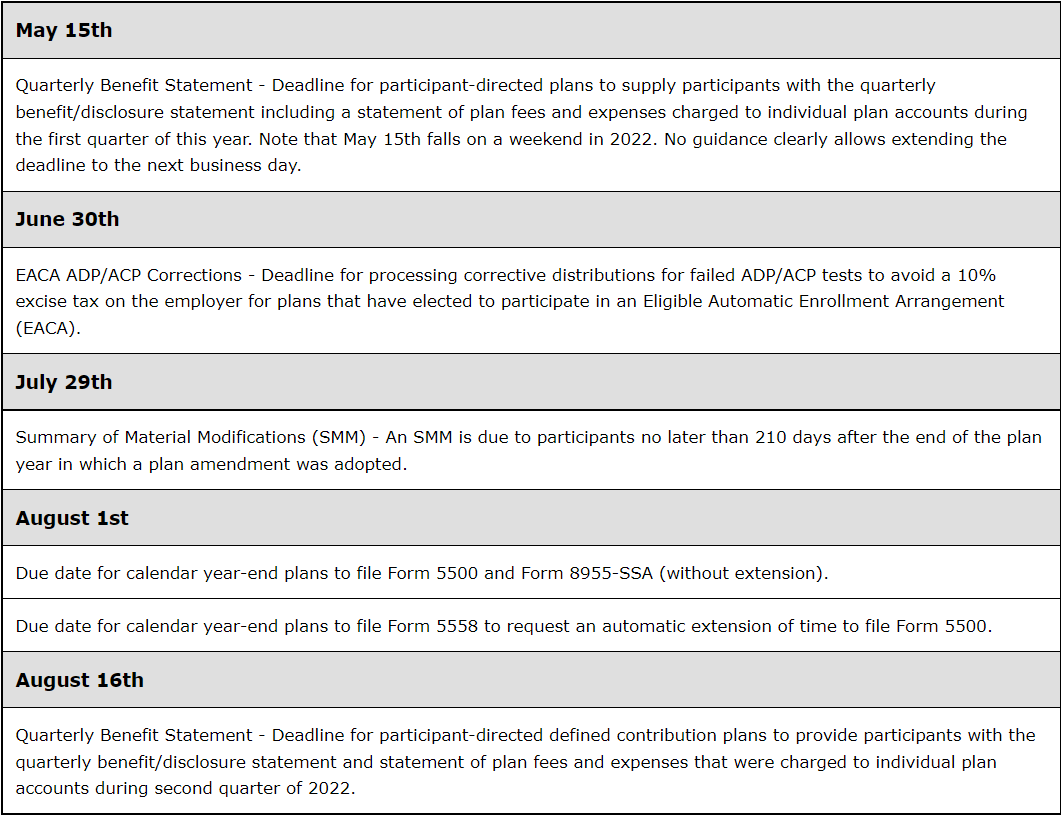

Spring 2022 The Retirement Plan Company Newsletter The Retirement Plan Company

Solved Following Are Transactions For Vitalo Company Nov 1 Chegg Com

Filing Extension Period Expiring Youtube

Solved Nov 1 Accepted A 15 000 180 Day 5 Note From Chegg Com

Magento 2 Extension Sub Account Sub Login To Create Unlimited Sub Accounts For User Accounts With Own Login Credentials E G In Case Of Employees

Understanding Profitability Ag Decision Maker

When Are Taxes Due In 2022 Forbes Advisor

Year End Accounting Checklist For Uk Limited Companies

Annual Accounts New Deadlines Granted To Luxembourg Companies Loyens Loeff

Temporary Extension To Companies House Deadlines Patterson Hall Chartered Accountants

Your Farm Income Statement Ag Decision Maker

Deadline Extension For Filing Of 2019 Financial Year Annual Accounts Dsm Avocats A La Cour Luxembourg

How To Apply For More Time To File Your Company Accounts

File Accounts Later With A Companies House Filing Deadline Extension Freshbooks Blog

South African Government On Twitter Details Of The Special Covid19srdgrant Extension For A Year Until March 2023 Sassacares Https T Co Oxqrsioq6t Twitter

Lessee Accounting For Governments An In Depth Look Journal Of Accountancy

:max_bytes(150000):strip_icc()/accountingperiod_definition_final_0929-6a0f18d7c7e744d4a1aee1de9e84d54f.png)